Webex demonstration

Contact SAFEChecks

(800) 755-2265 x 3311

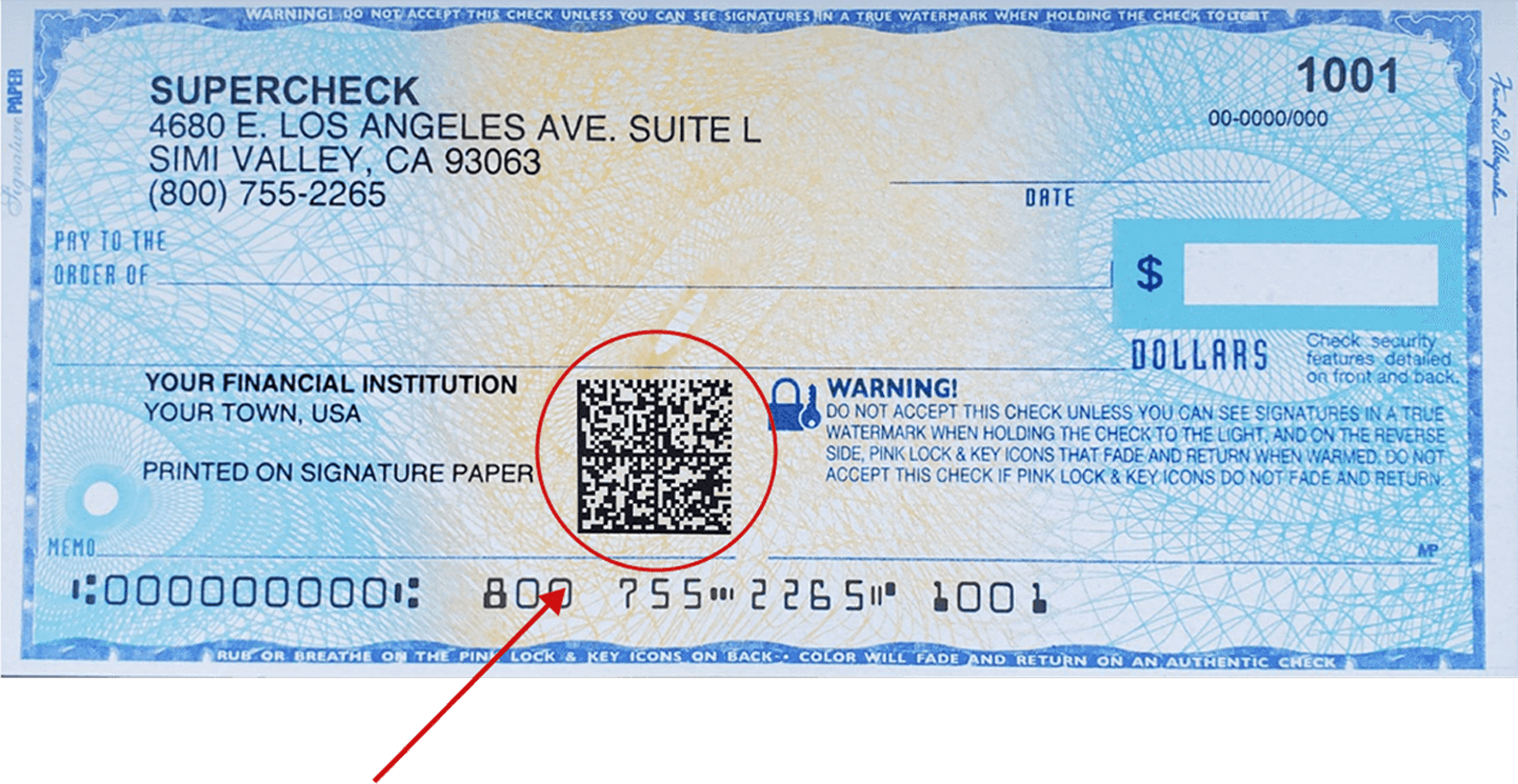

Encrypted Barcode Technology to Prevent Check Fraud

SAFEChecks, with select business partners provides technology and high-security checks to protect consumers, small businesses and banks from check fraud losses.

An encrypted "secure" barcode (illustrated above) pre-printed on handwritten checks is an exciting new innovation. The barcode is embedded with the account number, check number and account holder's name. The barcode on every check is unique because the number on every check is different.

How it works: A check with a pre-printed encrypted barcode is presented for payment against a bank account previously identified by the bank as a "barcode" customer. The bank's decryption software scans the check face, "reads" the barcode data and compares that data to the pre-printed information on the check. If the data matches, the check probably* is not counterfeit and the check is allowed to pay. (*We will not explain what "probably" means on this website.)

If the data does not match, or if a check without an encrypted barcode is presented for payment, that check is instantly identified as potentially counterfeit and is investigated further by the bank, and potentially returned.

These are the caveats:

- The bank needs to install the decryption software onto their system.

- Each barcode is unique and can only be used (presented for payment) ONE time. Checks presented with a duplicate (replicated) barcode are rejected.

- The encrypted barcode DOES NOT prevent check washing.

- Check Washing can be deterred or prevented by using checks manufactured on Signature Paper https://signaturepaper.com, which stains PERMANENTLY when chemically washed. All of our checks are printed on Signature Paper, designed with Frank Abagnale.

Secure Check Writing Software

SAFEChecks partners with Cheque Guard, a software company that specializes in secure laser check writing solutions. The software interfaces with all accounting and disbursement software. This state-of-the-art software includes a printer driver which produces a unique encrypted, “secure seal” barcode that is laser printed on the face of each check. The printer driver also prints the data using a Secure Name Font and a Secure Number Font. The software can also automatically create and securely transmit Payee Positive Pay files, allowing organizations to utilize their bank’s Positive Pay services.

The complete check writing software allows for maximum flexibility in check printing, ACH payments, check re-prints, etc. Every level of security is incorporated, including safeguards monitoring automatic signatures, levels of authorization, usage, etc. The software interfaces with all accounting and disbursement software.

Our checks and software help prevent check fraud losses by making the criminal’s task of altering or replicating a check more difficult. Discouraging the fraudster's attempt is the first step in check fraud prevention.

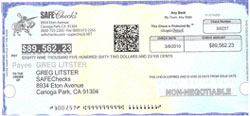

Image A: Check printed with "regular" software

Image B: Identical data through printed through Cheque Seal driver

If you were a fraudster, which check would you attempt to alter or replicate first?

The two check images above are printed from a standard accounting package. Image A is printed directly from the accounting software. Image B is printed from the same accounting software that was integrated with SAFEChecks’ Cheque Guard secure check writing software. The type of check data is identical. The check data is captured by the check writing software and re-configured, encrypted, and re-mapped.

Criminals are beating Payee Positive Pay (PPP) by adding a fraudulent Payee name two lines above the authentic Payee so it will not be detected by the banks’ PPP system. Our secure check writing software helps prevent added Payee names. The Secure Name Font eliminates the space where a fake Payee could be added.

The unique, encrypted, “secure seal” Barcode is laser printed on the face of each check. This barcode data can be “read” at the point of deposit using Optical Character Recognition (OCR) technology, and compared with the printed information on the check. If the information on the check does not match what is read in the barcode (which contains the authentic, correct information), the check can be rejected. The barcode is image-survivable, meaning it can still be read on the check image after the original paper check was converted into an image, and destroyed.

The encrypted,Secure Seal Barcode includes:

- Drawer (sometimes called the "maker")

- Payee Name

- Issue Date

- Dollar Amount

- Check Number

- Account Number

- Routing Number

- Date and Time the check was printed

- The laser printer that printed the check

- The employee that printed the check

The idea behind the secure seal barcode is to allow financial institutions to protect themselves against altered checks that are deposited into their banks. The barcode can be read at the point of deposit, allowing banks who have adopted this technology to compare the encrypted data in the barcode with the actual printed data (words and numbers) on the check being deposited. A handful of banks have already adopted this technology.

Contact SAFEChecks for a Webex demonstration

(800) 755-2265 x 3311

Commentary by Greg Litster, SAFEChecks’ President, on secure seal barcodes

The generic name for the barcode printed on the checks, as illustrated in this document, is "secure seal."

There are three levels of encryption, including an "active" encryption key, which prevents the barcode from being reverse-engineered. The Cheque Guard barcode contains the X,Y coordinate for every piece of data on the printed check, and can be read and compared, even if the check image is skewed, or is upside down.

Data encrypted into the barcode include the drawer (issuer), payee name, dollar amount, issue date, check number, account number, bank R/T number, the date and time the check was printed, the laser printer used, and the employee that printed the check. It is, in effect, an on-board Payee Positive Pay file for that check.

The barcode is image-survivable, and because banks retain check images for seven (7) years, if someone were to embezzle from a company by printing a check, the check's issue data could be retrieved for the court.

Cheque Guard's founder and Chief Information Officer, Emil Ramzy, has been awarded a US patent on how this barcode is created and how the re-construction of the encrypted data is done. The Cheque Guard barcode is the only provider that allows the barcode to be reconstructed back to the original printed data. Other providers create a barcode from a "hashing" of the letters and numbers on the check that converts into a string of integers that is then converted into a barcode. A barcode created from a hashing of characters cannot be re-converted backwards to the original words and numbers without accessing an outside data base.